Understanding Risk Management in Forex

The Basics Of Risk Management In Forex

The Basics Of Risk Management In Forex

Risk management is vital in Forex, especially if you’re new to the whole trading scene. Many new traders get lured to the markets with the promises of huge gains and double or triple figure percentage returns, but what brokers won’t tell you is that you are just as likely if not more likely to lose those types of figures as well. It’s extremely important for you to support any winning trading strategy with a solid risk management strategy as well, otherwise you will experience extremely volatile account performance that will be hard to stomach even for the most emotionally stable trader.

Good risk management starts with the right attitude, and you need to be concerned with protecting your capital first and foremost. Risk management is all about preserving the safety of your capital, and not risking too much of it at any given time. You will often hear about the 2% rule in forums and discussion boards online, and this is a good starting point for any new trader when it comes to managing the risk of their trading account for maximum gains with the minimum risk.

What Happens When Traders Ignore Risk Management

Most new traders will risk anywhere between 20% – 100% of their account equity at any given time, and this is an extremely dangerous practice because it exposes you to massive losses if even a few trades go against you. It’s not uncommon for traders to experience multiple consecutive losses in their day to day trading, and even if you risk 10% of your account in each trade, you’ll find yourself seriously underwater with three or four full losses. When you fall so far into the red in your trading, you may begin to take even bigger risks to try to get back to the break even point, and before you know it, you may have blown up your entire account.

Rather than aiming for huge 100% returns in a matter of weeks, and risking your entire account in the process, try aiming for smaller returns instead. After all, even if you just made a 2% return each month, you would make over 20% a year and outperform many other professionally managed funds and investment vehicles. When you dial down your risk per trade, even if you suffer a really bad run of losses, you still won’t be too far behind to realistically be able to recover your losses and get back into the profit zone.

The 2% Risk Management Rule Explained

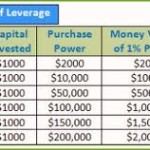

Now that we’ve established the importance of keeping your risk per trade small, the question then becomes: how small? As I mentioned, the most popular and well known strategy is the 2% fixed percentage of capital strategy. In this risk management strategy, you can only risk up to 2% of your capital on any given trade, and you shouldn’t risk more than 6% spread over all your open trades at any given time.

In this strategy, your risk per trade is tied to your account equity, so as your account equity decreases, your position sizes decrease as well, and as your account equity increases, your position size will increase proportionally. Effectively, this means that you will lose less money on your losing streaks, and gain more money on your winning streaks, leading to optimal account growth and minimal account drawdown.

Why 2% though? Risk management studies have shown that risking this amount per trade is a good rule of thumb for minimal account drawdown and maximum account growth. In fact, you will grow your account equity far more optimally using a fixed percentage of capital strategy than a fixed dollar risk like $1,000 per trade for example. All in all, this is a good place to start with your risk management, and as you gain more experience with your trading, you can further tweak the percentage risk per trade for better results based on the nuances of your own trading system.

Related Posts

Our recommended CFD broker:

![]() This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!

This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!