Low Interest Rates to Affect Dollar and Euro

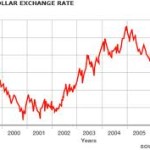

In the recent months, the dollar and euro have been struggling. Though the dollar has gained in the past few weeks – when the euro faces a possible debt crisis in Europe – the currency still has to deal with a few challenges. The Federal Reserve has indicated that the rate for overnight lending is likely to be retained till the middle of 2013.

In the recent months, the dollar and euro have been struggling. Though the dollar has gained in the past few weeks – when the euro faces a possible debt crisis in Europe – the currency still has to deal with a few challenges. The Federal Reserve has indicated that the rate for overnight lending is likely to be retained till the middle of 2013.

Feds may Push Zero Rate into 2014

In a recent meeting, the Federal Reserve stated that it plans to publish its projections of interest rates along with economic forecasts for each quarter. Following this announcement, a few analysts stated that the Fed may push the zero rate to 2014.

A key reason behind this opinion is the fact that some of the members of the policy committee of the Fed, who have a hawkish leaning will be leaving. They will then be replaced by regional presidents who have a dovish tendency. The latter will promote policies that will allow for the maintaining of low interest rates. One of the concerns that most nations have with low interest rates is that the exchange rates fluctuate and affect its currency.

If the Fed takes the step to retain low rates, it will weaken the dollar. The likelihood of this increases in case the Fed carries out another bond purchase. This will happen if the Fed opts for quantitative easing with the aim of retaining low interest rates for the long-term.

Though the third round of quantitative easing has not been confirmed, it cannot be ruled out till the economy moves away from recession and reaches a state of true recovery. Politicians and market experts have stated that if the Feds resort to printing money with the aim of buying debt, there will be an inflation spike.

European Central Bank may Follow in Fed’s Footsteps

While the US faces a possible debt issue, Europe is in the middle of a crisis. To deal with this, the European Central Bank may follow in the Fed’s footsteps and bring down the interest rates. It may even drop the rate close to zero. In December, the Central Bank reduced its rates to one percent. This was the second reduction to have taken place in the past few months.

Related Posts

Our recommended CFD broker:

![]() This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!

This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!