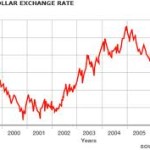

Weekly Loss for Euro against Yen and Dollar

The Euro registered its first loss in the second week of August against the Yen, which is fast becoming competitive, and the United States dollar. This was a consequence of the investors being hesitant to move forward aggressively, following the European Central Bank’s lack of action to provide a bailout solution. Meanwhile, the economic crisis around the world, especially in the Euro zone, continued as the debts kept increasing and the growth rate only went downhill.

The Euro registered its first loss in the second week of August against the Yen, which is fast becoming competitive, and the United States dollar. This was a consequence of the investors being hesitant to move forward aggressively, following the European Central Bank’s lack of action to provide a bailout solution. Meanwhile, the economic crisis around the world, especially in the Euro zone, continued as the debts kept increasing and the growth rate only went downhill.

Chinese Exports and German Data Disappoint

Investors expected to see some encouraging numbers in the increasing Chinese exports which could have signified a change in the fortunes. However, the figures were much lower than what it was expected to be. The German data also failed to impress the investors as low figures caused concerns among the market experts about the existing crisis worsening and spreading to other parts of the world also.

Yen and Dollar Boosted

The lack of encouraging data was good for the newly christened safe havens of investments, the United States dollar and the Yen. The dollar and yen recorded significant increase in their values. On the other hand, some of the currencies like the Australian and Canadian dollars, value of which are based on commodities, was subjected to much pressure and looked to be tethering on the brink of a fall.

Profits Sparked by Rallies Short-Lived

When the president of the European Central Bank, Mario Draghi, had undertaken a rally and boldly announced that the bank would do everything possible within its power to resolve the existing crisis, the market was hopeful. The investors had recorded profits after a long time. However, people seemed to realize late that this intervention from the ECB was not as simple as it sounded and depended on a lot of factors, including the release of the crisis funds of the Euro zone. Germany was very much against the release of these funds and the leaders fought to find out other solutions to this crisis, which did not involve the Euro zone crisis fund.

The future is looking very bleak for the Euro unless there is a drastic change in the policies of the European countries and America, which is most likely not going to happen.

Related Posts

Our recommended CFD broker:

![]() This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!

This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!