What is Leverage in Forex?

How does Leverage work in Forex?

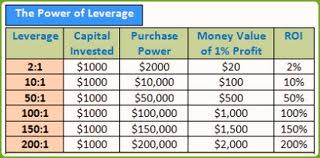

So what is leverage anyway, and how does it work in Forex? You’ve seen Forex brokers advertise that they offer leverage of 100:1, 200:1 or even 500:1. Basically, when you are offered 100:1 leverage, what that means is that you get to borrow up to 100 times what you put up as a deposit. So if you have $1,000, you can borrow up to $100,000.

As you know, one full sized contract is generally worth $100,000 or 100,000 units of the base currency. With $1,000, you have sufficient margin to cover one standard contract. The great thing about leverage is, you can make a very big return on your trading capital if things go your way. However, it’s a double edged sword, as you will hear very often, because you can just as well make a big loss as well.

What Leverage Means For Your Trading

What Leverage Means For Your Trading

As much as leverage allows you to make huge returns on your capital with very small moves in the Forex market, it will cause you to lose big if the same move goes against you. As I mentioned above, you can control $100,000 with $1,000 in your account, but that doesn’t mean you can just go and buy one standard contract with just $1,000 in your account. What the 100:1 leverage means is that you’ll always need $1,000 of equity in your account to maintain control over your 1 standard contract. It’s a very subtle distinction, but an important one nonetheless.

Let me explain. Imagine if you only had $1,000 of available equity in your account, and you bought 1 standard contract. You would immediately max out your available equity, because you would need to put up the full $1,000 as margin. The moment the prices go against you, even by one pip, you will have insufficient margin to cover your control over the contract. You will be subject to a margin call to warn you to top up your margin. If you ignore this warning, then your broker will automatically close you out once your equity drops below 80% because you have insufficient margin to cover your position.

That means that with your $1,000 deposit, you should only be able to control a fraction of the standard contract, and even then you would be cutting it extremely close risk-wise.

The Effect Of Greater Leverage

The more leverage you are offered, the less margin you have to put up to control the same position. In the case of 200:1 leverage, you only need $500 as margin, and in the extreme scenario of 500:1 leverage, you only need $200. Now, there’s nothing wrong with having a great deal of leverage available to you. However, this leads to people over leveraging themselves, in other words trying to control contract sizes that are too large for their account side.

Let’s say you have an account size of $1,000 and you wish to purchase 1 standard contract. As we demonstrated in the earlier 1:100 leverage example, you can’t do it because you won’t have enough margin to cover the position. However, with 500:1 leverage, you do. The thing is, you’ll still only have enough money in your account to cover an adverse move of just 80 pips before you get into a margin call situation. Many people are even more extreme and try to trade 1 full sized contract position with just $300-$400, which is suicidal. The prices just need to go beyond you to the tune of 10-20 pips, and you’ll be in serious strife.

You may think that you’re still safe, after all, you can only lose the money you have in your account, right? No, in the case of an unexpected high impact event like an earthquake or an unexpected crisis announcement, prices can move against you faster than your broker can institute a margin call and close out your position. If this happens, you’re still liable for the full amount of your losses, which can be in the thousands of dollars. All in all, it’s a good idea to be under leveraged and always have a healthy amount of margin in your account, so that you won’t be burned by an unexpected margin call and see your position closed out prematurely.

Related Posts

Have you Tried Binary Options Trading Yet?

Binary Options trading is one of the newest forms of trading to hit the markets. Binary options allows you to trade currencies, stocks or indices with fixed odds. For more information visit our recommended broker now:

Binary Options trading is one of the newest forms of trading to hit the markets. Binary options allows you to trade currencies, stocks or indices with fixed odds. For more information visit our recommended broker now: