Economy Fears Intensify as More Slowdown Indicators Appear

The uncertainty in world markets continues to plague traders as various economies exhibit a slow down. On one hand, analysts have been talking about a second recession in the European countries.

The uncertainty in world markets continues to plague traders as various economies exhibit a slow down. On one hand, analysts have been talking about a second recession in the European countries.

China has chosen to take a step back and released a downward revised GDP prediction. The uncertainty about oil has increased volatility in its price movements. These slowdown indicators are causing investors to develop a discouraging outlook for the future.

One thing is very clear, forex trades should be entered into with a great deal of caution in coming weeks since it is impossible to predict which economies (and as a result, their currencies) will perform in which way.

U.S. Investors Choose to Remain Cautious In Spite of Data

In the U.S., the data showing immense expansion in the services sector has not had the positive impact that was expected from it. Apparently investors are choosing to check their impulse to resume investing because of China’s cautious approach to the coming year’s growth prospects.

U.S. investment analysts are saying that there is concern about a bigger downslide taking place that will wipe out all the upward movement and then some. The Dow Jones industrial average, S&P 500, Nasdaq’s Composite have all dipped. Materials shares were by far the worst hit.

The European Story

In European markets, resources stocks lost the most heavily. Considering that China is the world’s largest raw material consumer this makes perfect sense. In spite of the injection of funding to European banks just last week, purchasing managers’ assessments are not heartening at all.

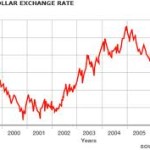

The Euro seems to be rallying against the dollar right now. However, with the markets remaining quite volatile, there is no way to predict exactly how this pair will stablize Poor Eurozone data and continuing concerns about the Greece debt swap will continue to keep the pressure up on the currency.

A Balanced Approach will Help

Analysts warn that while the Euro’s bounce should not be taken for granted, traders should also take care not to write off either the Euro or the dollar right away. The U.S. economic recovery is picking up pace, as stated by Ben Bernanke, Fed Chairman. This is bound to add impetus to this economy in the coming weeks. Forex traders should view all this data in conjunction to aid decision making as several economic factors are coming into play simultaneously now. A balanced approach to investing should prove to be most invaluable right now.

Related Posts

Our recommended CFD broker:

![]() This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!

This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!