Introduction to OCO Orders

Using stop orders and limit orders are an essential part of Forex trading, and if you are using these orders to place and manage your trades, you should get familiar with OCO or “one cancels the other” orders as well. The way the OCO order works is that if you have two orders in the market, you can specify that if one of them is executed, then the other is automatically cancelled.

For example, if you’re holding a long EUR/USD position at 1.3000, and you want to either exit at limit at 1.3050 or stop out at 1.2980, you would set these two orders to be OCO. That way, if you exit at your profit target of 1.3050, and the price falls back down to 1.2980 before you have the chance to cancel your order manually, you won’t be filled for that order as well. In other words, it’s a handy way to ensure that you don’t have any floating orders lying around that will get you into trades that you don’t want to get in to.

Using OCO Orders To Exit Trades

By default, most brokers these days automatically set your stop and limit orders on open positions to function on an OCO basis. As long as your position remains open, both your stop and limit orders will remain active, and you can adjust the stop and limit prices as you see fit. Once one of these orders are executed, then the other will automatically be cancelled as per the OCO function.

If you don’t already use stop or limit orders in your trading, I encourage you to do so. It’s a critical part of a traders education to learn how to plan trades and to stick to the plan, and obviously a big part of any trade plan is where to stop out and where to take profits. By using stop and limit orders, you train yourself to get out where you are meant to get out, instead of being subject to emotional pitfalls like fear and greed.

Using OCO Orders To Enter Trades

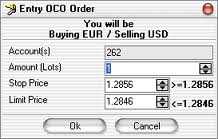

A little known strategy for using OCO orders is to enter trades following high impact news releases or announcements. If you don’t know which way the market is going to move, but you know it’s going to be a big one either way, you can use a OCO order to enter on stop either long or short. For example, if you’re trading Non Farm Payrolls and the EUR/USD is trading at 1.3000, you can plan for a trade in both the long and short directions using a OCO to enter on stop either at 1.3020 or 1.2980.

When the price breaks one way and executes either the long or short entry, the OCO will automatically cancel the other order so that it won’t be executed if the price comes back to that point. This can be quite a lucrative strategy as long as the price breaks strongly in one way or the other.

It’s important never to assume that a pair of orders are OCO unless you have manually set them to be. Always check that your broker supports these orders, and double check your orders to ensure that they are in fact set as OCO. Otherwise, there may be unexpected executions of orders that you assumed were OCO, which will cause you to incur unnecessary execution costs, as well as unexpected losses on open positions that you didn’t know were there.

All in all, OCO orders are a very handy tool in any serious trader’s arsenal. Why not try out OCO orders in your trading and see how you can improve your trading results with them?

Related Posts

Our recommended CFD broker:

![]() This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!

This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!