What is the Spread – Forex Trading

Have you ever wondered what is the spread and why it exists?

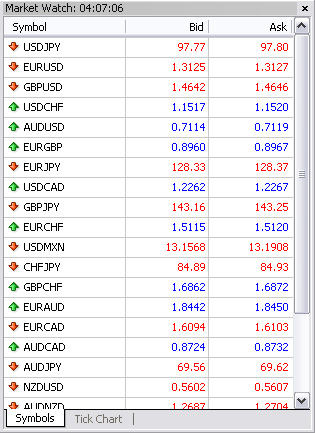

For the uninitiated, the bid is the best selling price on offer, and the ask is the best buying price on offer. There’s always a difference between the bid and the ask (a.k.a the spread), meaning that you can never buy at the same price as you can sell at any given time. This difference is there as a profit for the party doing the transactions for you, which is your Forex broker.

There is a considerable risk for the broker when they take your trade, because they have to immediately place the order into the market before the price moves against them. Therefore, it makes sense that they get to pocket most of the spread if they have good execution capabilities. If you observe a broker with a wider than normal spread, it just means that they have poor execution capabilities, or they need the extra to pay their introducing brokers and affiliates.

What The Spread Means For You

As a Forex trader, don’t worry yourself about your broker’s profitability. They take more than enough to be profitable if they do their job right. Your job is to get the best possible deal for yourself, because every pip you save in paying the spread is a pip that you get to keep in your “profits” column. Even 0.5 pips saved on each round turn lot traded is a huge saving over time, because it represents $5. Imagine if you traded a hundred or even a thousand lots a month… could that little bit extra make the difference between you making a profit and you making a loss in a month? Of course!

When you’re shopping around for the best possible spread, make sure that your broker offers you fixed spread and not variable spreads. Fixed spreads mean that you can always expect to pay the quoted spread no matter what time of the day or night it is. So if your broker has told you that the EUR/USD is on a fixed spread of 2 pips, then that’s what it’s going to be even if it’s 4 a.m. on a Tuesday morning. On the other hand, if you’re being offered variable spreads, that means that your spreads are likely to fluctuate, and generally it’s not for the better. In really illiquid times, you could see even a tight spread like the EUR/USD go from 2 to 3 or even 4 pips!

ECN Accounts – What Are They?

If you shop around for a good spread, you’ll most likely encounter a type of account called the ECN account, which is short for Electronic Communications Networks. You’ll observe that these type of accounts generally have a much tighter spread (as in, you get a better deal) and that’s because these order taking and placing systems are entirely automated.

Once you’re registered for an ECN account, you can go directly to the market without the need for a broker to place your orders for you. As such, the risk to them and the work involved is vastly reduced, and you can enjoy a much better spread than if you traded with the standard accounts you’re used to. The ECN is able to instantly match buyers and sellers and execute the trades, which is why it costs far less to trade with than standard accounts. However, you will need to have a much larger account size to qualify for such an account.

If you have enough to make up the deposit, trading with an ECN Forex account is definitely attractive because you’re getting a very competitive spread. Over time, you’ll save a significant amount of money just from the reduction of the spread that you pay alone. Clearly, the spread plays a very big role in the profitability of any Forex trader, so do consider these spread reduction methods in your pursuit of greater Forex profits.

Related Posts

Our recommended CFD broker:

![]() This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!

This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!