Forex Trading Volume Drops, After a Gap of Over 2 Years

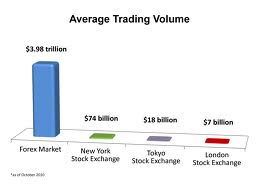

The semiannual report that was recently released by four major central banks of the world has revealed that there was a decrease in the overall forex trading volume in October 2011. This, according to the report, was the first time that the volume dropped sequentially, although the overall volume seemed to have improved by 15% over the past year. The survey has also reported that the combined trading volumes of the UK, Australia, North America and Singapore, which represent a major chunk of world forex market, had decreased from $3.474 trillion in April 2011 to $3.470 trillion in October 2011.

The semiannual report that was recently released by four major central banks of the world has revealed that there was a decrease in the overall forex trading volume in October 2011. This, according to the report, was the first time that the volume dropped sequentially, although the overall volume seemed to have improved by 15% over the past year. The survey has also reported that the combined trading volumes of the UK, Australia, North America and Singapore, which represent a major chunk of world forex market, had decreased from $3.474 trillion in April 2011 to $3.470 trillion in October 2011.

What caused the decline?

The drop in the forex trading volumes between April and October 2011, first time after the recession on 2009, was largely motivated by the foreign-exchange swaps. This was because the FX swaps included interbank loans, which play a central role in the global economic system. Because of the European sovereign debt issues and the threat of insolvency for several European financial institutions, banks were reluctant to lend, which in turn made the foreign exchange swaps quite expensive. Just between July and November, the cost of borrowing dollars and lending euros had increased by 5 times.

Drop in FX swaps, overall spot trading volumes

Between April and October, the rising swap rates had led to an 8% decline in the foreign exchange swaps in the UK, Australia, Singapore and North America, bringing down the trading volume to just $1.368 trillion per day. On one hand, banks were cutting down their swaps. But on the other, there was an increase in investors’ spot trading activity, especially in North America and UK. Although the trading volumes in UK and US rose by 2% and 14% respectively, the volumes in Australia and Singapore dropped by 23% and 1.2%, bringing the overall spot trading volumes down by 3% to reach $1.972 trillion.

However, the lending conditions improved after October, with the European Central Bank allotting 489 billion Euros to over 500 banks in December. But whether the situation is going to remain stable or get worse depends on whether or not Greece comes to a favorable consensus with its creditors.

Related Posts

Our recommended CFD broker:

![]() This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!

This is a higly recommended broker. Enjoy risk-free trading with their free demo account! (Risk warning: 76.4% of retail CFD accounts lose money.)!