What is the Margin in Forex?

What is Margin?

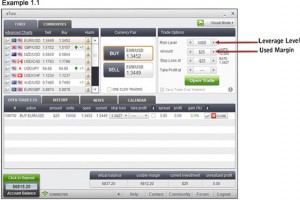

So what is margin anyway? It’s a term that all of us Forex traders know that we need to have in our account to open up a trade and to keep it open, but how exactly does it work? Well, essentially, your margin is a deposit for the entire borrowed amount that you use to control the entire Forex contract. As you know, each contract is worth 100,000 units of the base currency of the pair, meaning that you’re essentially borrowing those 100,000 units with whatever margin you are required to put up for that position – this is known as leverage in Forex.

When you borrow money, you would expect to pay interest, right? So where’s the interest component in this transaction? Well, if you are a day trader, you don’t have to pay this interest at all. And if you hold your position past the “rollover date”, you either earn interest or pay interest depending on the swap rate of the pair. Anyway, even if you do pay or earn interest, it’s typically quite small on most positions so don’t get caught up with it unless you’re a carry trader, which is a topic for an entirely different article.

The amount of margin you need to put up depends on the level of leverage your broker is willing to offer you. If your broker offers the standard 100:1 leverage, that means that you need $1,000 of margin to control 1 standard contract. However, in the case where there’s 500:1 leverage on offer, you only need to put up $200 for the same position.

While this may come across as a good thing, many traders make the mistake of over leveraging and under capitalizing themselves. In other words, they take on too large a position and when the market moves slightly against them, they find themselves subject to a margin call. A margin call happens when your equity falls below your required margin. You usually have 24 hours to make up the difference but if your equity falls below 80% of the required margin typically your broker will immediately close out your position.

In extreme cases, especially where there’s a severe market shock, your broker may not close out your position in time. When this happens, you’ll likely lose all your money or even end up in debt to your broker.

Preventing The Dreaded Margin Call

Trust me when I say that you don’t want to get a margin call on your account. If you’re over leveraged and under capitalized, your position will get closed out prematurely. Inevitably, the move will reverse and head right for your profit target the moment you are out of your position. Simply put, it’s not worth the risk. The easiest way to prevent a margin call on your account is to ensure that you have plenty of free equity available to cover any additional margin you require to maintain the position.

Another way to reduce your margin is to set a stop loss on your position. Because the stop further reduces the risk of loss, this has the effect of reducing your margin as well. Typically, your margin with a stop is the number of pips away from your entry plus a factor of 25-50%.

As a general rule though, you should never trade your account to the hilt. In other words, you should always only use a fraction of your available equity to trade. This is good risk management practice and will ensure that you don’t wipe out your account in just one or two trades. This is not just to ensure that you will always have sufficient margin to weather even the worst adverse market movements, but it’s vital for your own peace of mind as well. If you’re always living on the edge, you’ll find it really difficult to sleep at night and focus on your other tasks during the day.

All in all, margin is a good thing as it allows us to control large Forex contracts that we would otherwise not be able to afford. However, instead of abusing this facility, you should use it wisely to ensure that you are getting the best return without taking crazy risks.

Related Posts

Have you Tried Binary Options Trading Yet?

Binary Options trading is one of the newest forms of trading to hit the markets. Binary options allows you to trade currencies, stocks or indices with fixed odds. For more information visit our recommended broker now:

Binary Options trading is one of the newest forms of trading to hit the markets. Binary options allows you to trade currencies, stocks or indices with fixed odds. For more information visit our recommended broker now: