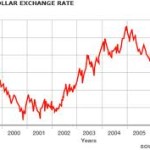

Euro Plunges Against Dollar Amidst Fears About Eurozone

During trading Friday, the euro plunged against the dollar to a new low in the past 23 months. Chinese data that was weaker than what was expected, brought down the confidence in a market that was already quite bearish, in the middle of fears that the debt crisis in the euro-zone will rise.

During trading Friday, the euro plunged against the dollar to a new low in the past 23 months. Chinese data that was weaker than what was expected, brought down the confidence in a market that was already quite bearish, in the middle of fears that the debt crisis in the euro-zone will rise.

The Australian dollar, a commodity currency, was affected badly when the May purchasing managers index for China dropped from 53.3 to 50.4. The figure was below the 51.5 mark the market expected it to reach. According to Brown Brothers Harriman’s senior currency strategist, this is a sign that the economy in China is slowing.

Really strong political ties important for eurozone to gain stability

In Europe, Mario Draghi the head of ECB stated that without really strong financial and political ties, the euro zone will continue to be unsustainable and stay in its debt crisis. He made it clear that the ECB will not be able to meet the deficit that has been created because of member states’ hesitation to act. Draghi added that as filling in the vacuum was not in the bank’s mandate, it does not have the power to stop the crisis from escalating.

The economy minister of Spain, Luis de Guindos, requested Berlin to play its part in helping the country bring back the eurozone’s health. Guindos stated that Italy and Spain are fighting hard for the euro, the currency whose future is at stake.

IMF has no plans of bailing out Spain

According to the head of the International Monetary Fund (IMF), Christine Lagarde, the organization was not preparing to bail-out Spain. She stated that the IMF has not received requests to do this and that the organization is not working to provide financial support.

The economic official at the European Union, Oli Rehn, stated that this situation merits immediate attention to prevent the eurozone from disintegrating. According to the commissioner of economic affairs, politicians were doing their share in this regard, and that despite it, progress appears to be unbalanced and ineffective.

Beneath fears that most investors are facing, is the fact that in May this year, the FTSE closed down 7.5%. This was the worst it had fared since 2009 February, when the financial crisis was at its worst.

Related Posts

Have you Tried Binary Options Trading Yet?

Binary Options trading is one of the newest forms of trading to hit the markets. Binary options allows you to trade currencies, stocks or indices with fixed odds. For more information visit our recommended broker now:

Binary Options trading is one of the newest forms of trading to hit the markets. Binary options allows you to trade currencies, stocks or indices with fixed odds. For more information visit our recommended broker now: